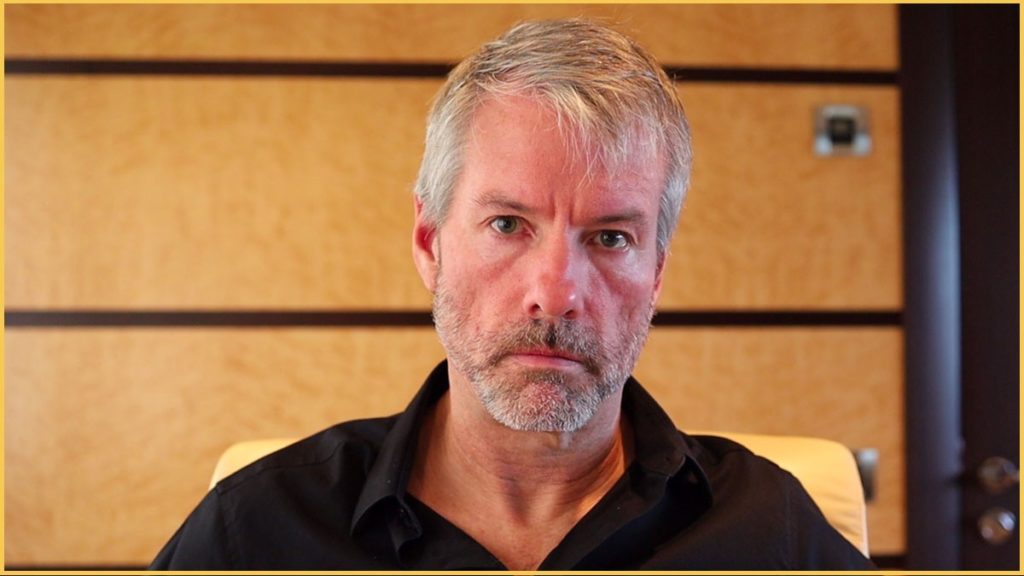

After his firm stated that BTC will be added to their balance sheet in 2020, Michael Saylor became one of the most vocal proponents and shills of Bitcoin.

The dot-com boom, which lasted from 1995 to the 2000s, was one of the greatest in history.

20 years ago, Fortune magazine compiled a list of who was impacted the worst during the tech bubble using data from Thompson Financial and Bloomberg.

The whole business of Michael Saylor was predicated on falsehood.

The SEC also found that, rather than profiting , they were losing money.

Saylor stated that they would be paying directors in Bitcoin and that they would be launching a new subsidiary named MacroStrategy LLC to house their existing 92,079 bitcoin.

Because it is a private subsidiary, he will not be compelled to file his Bitcoin sales with the SEC.

While announcing their purchase, Michael Saylor quietly unloaded $63 million in bitcoin.

Despite all of the above mentioned concerns regarding Michael Saylor and his organization, there is still more to be concerned about.

The insider sales are suspect since they occur at such a crucial moment.