It’s the latest round of market upheaval since the outbreak of Covid-19 roughly two years ago, with the virus repeatedly tilting Wall Street’s assumptions about whether people would shop, travel or even turn up for work.

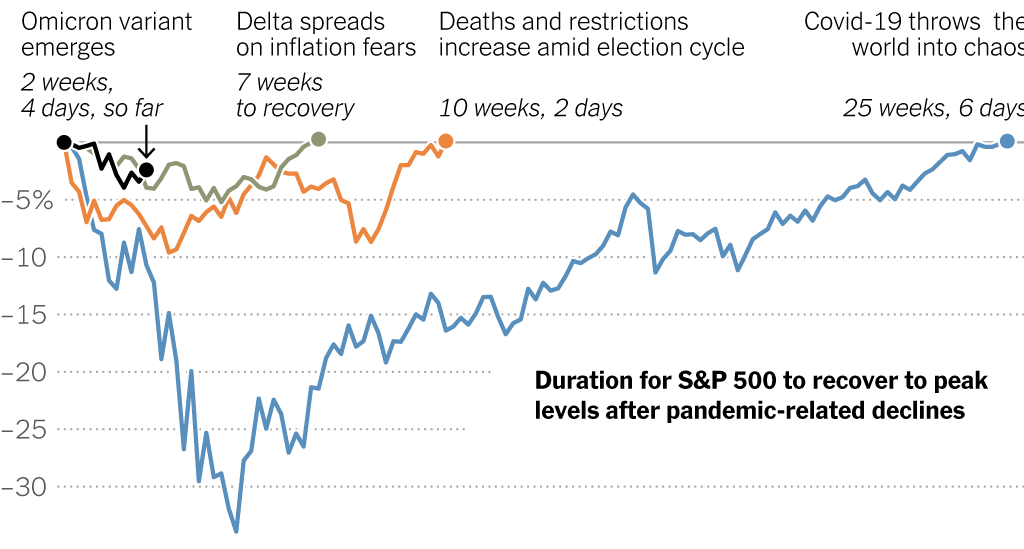

Each bout of pandemic-driven volatility in the stock market since February 2020 has been shorter than the one before, and followed by a recovery to a new high.

The stock market has often been a barometer for the path of the pandemic, tumbling after concerning milestones, and rising on advancements of vaccinations and new treatments.

2020 Case counts exploded and the death toll kept rising, fueling concerns that new restrictions might again pinch the global economy.

presidential election, the S&P neared a correction, a symbolic yet worrisome milestone on Wall Street.

Coupled with the uncertainty around the U.S.

In recent weeks, Wall Street’s economists have begun trimming their forecasts for economic growth, some of them citing the impact that the variant could have on the pace of reopening.

If it prompts tighter lockdowns, it could force factories to shutter, exacerbating shortages of everything from cars to building materials.