The Company is also excited to announce that it has engaged Tutchone Environmental Consulting, a Little Salmon Carmacks First Nation citizen owned business, to commence surface water baseline studies throughout the Project area.

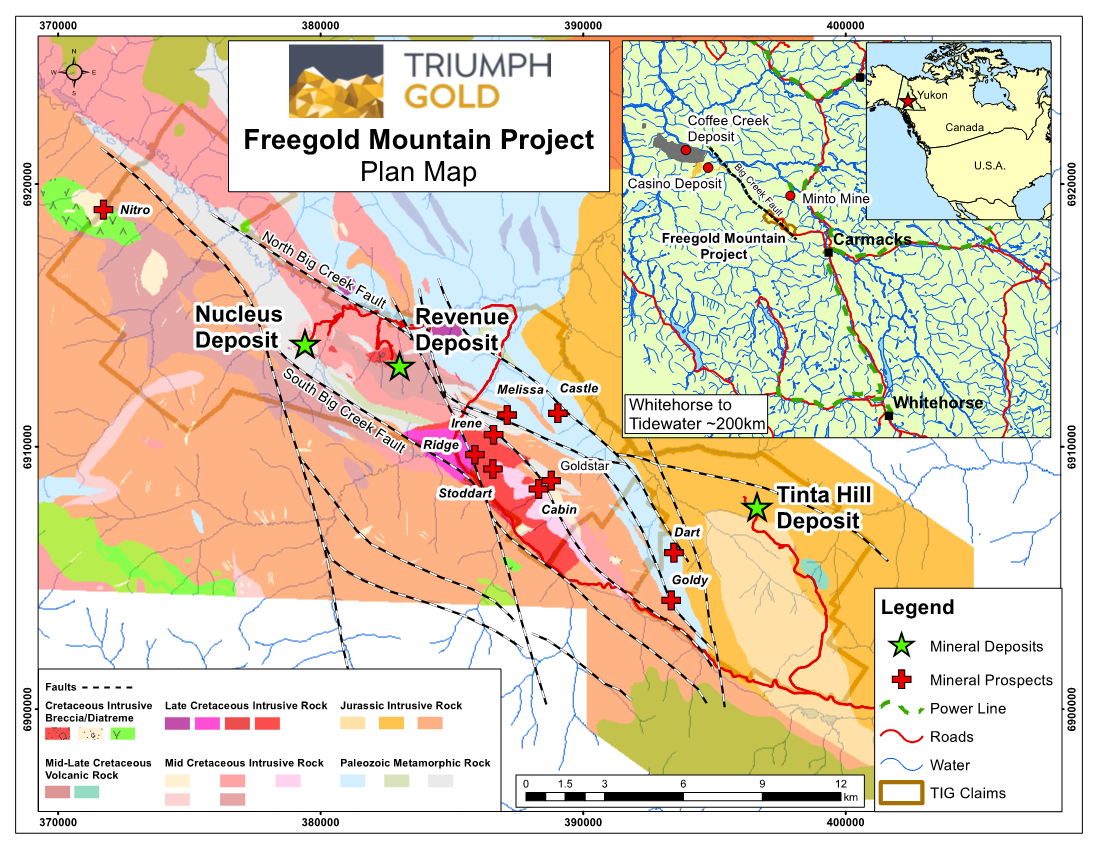

The Freegold Mountain Project is situated within a northwest trending belt of Paleozoic-aged metasedimentary and lesser metavolcanic rocks intruded by Jurassic-aged plutons.

The Revenue Creek discovery led to the Revenue gold-copper-molybdenum deposit and subsequent discovery of the adjacent Nucleus gold-silver deposit.

The Freegold Mountain Project is host to three NI 43-101-compliant mineral resource estimates: The Nucleus, Revenue, and Tinta Hill Deposits.

With recommendations from the Yukon Government and Yukon Chamber of Mines, the Company has developed and implemented infection prevention and control measures at the Freegold Mountain Project to minimize the risk of potential coronavirus disease transmission in the camp and related work sites.

The Project covers an extensive section of the Big Creek Fault zone, a structure directly related to epithermal gold and silver mineralization as well as gold-rich porphyry copper mineralization.

Important factors – including the availability of funds, the results of financing efforts, the completion of due diligence and the results of exploration activities – that could cause actual results to differ materially from the Company’s expectations are disclosed in the Company’s documents filed from time to time on SEDAR .

import prices increased more than expected in March, lifted by higher costs for petroleum products and tight supply chains in the latest data to show inflation is heating up as economies reopen.

Commerce Department said the seven Chinese entities were “involved with building supercomputers used by China’s military actors, its destabilizing military modernisation efforts, and/or weapons of mass destruction programs.” Companies or others listed on the U.S.

Treasury yields weighed on bullion’s appeal, while investors awaited speeches by several Federal Reserve officials in the wake of data showing higher inflation.

Coinbase’s launch, done through a direct listing where no shares are sold ahead of the debut, marks a victory for digital currency advocates in a year that has seen a clutch of mainstream, top-tier firms dive into the space.

The reference price is not an offering price for investors to purchase shares, but rather a benchmark for performance when the stock starts trading the exchange on Wednesday.

The Finance Ministry has had to rely on state-run banks to meet demand at its latest debt auctions after a sale was canceled due to reduced appetite from foreign buyers.What’s Sparking Tension Between Russia and Ukraine?: QuickTakeThe Treasury Department warned in 2018 of global financial market turmoil if Russia’s sovereign debt market were sanctioned because of how deeply tied the Russian market is to global indexes.Since then the California Public Employees’ Retirement System, or Calpers, has cut all of its bond holdings in Russia.

Rising commodity prices may push the current-account into a deficit in the fiscal year that started in April, while the central bank’s quantitative easing announced last week is seen adding to the liquidity glut, worsening the rupee’s woes.However, Barclays Plc expects the Reserve Bank of India to defend the rupee using its massive foreign reserves.“The RBI will likely sell USD into this bid as this move is relatively outsized,” said Ashish Agrawal, head of FX and emerging markets macro strategy research.

central bank has a legacy of missing its 2% inflation target consistently since it was installed in 2012.“Really it’s about changing peoples’ mindsets and experience for the last ten years,” said Tiffany Wilding, economist at Newport Beach, California-based Pacific Investment Management Co.“You are going to need several periods, maybe several years, of inflation that is running above the Fed’s 2% target to really anchor those expectations, because they have moved down.”For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2021 Bloomberg L.P.

Norwegian Air now aims to raise up to 6 billion crowns in fresh capital, up from a planned 4.5 billion, to bolster its resources before emerging from bankruptcy protection next month as the pandemic continues to curb travel.