Based on the significantly expanded Mineral Resource Estimate , with continued opportunity for growth as the Goldboro Deposit remains open in all directions.

It includes inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized.

Based on the technical and financial merits demonstrated by the PEA, the Company is undertaking a phased development approach which will initially focus on the surface mining phase of the mine plan, which is subject to an ongoing Feasibility Study expected to be released in Q4 2021.

The Company plans to execute the mine plan outlined in the PEA in phases, commencing initially with a Feasibility Study focused on the initial 10 years of surface mining, which is anticipated to be released in Q4 2021.

If a production decision is made, Anaconda will then commence the next phase of planning for underground mining, including infill and expansion drilling from drifts off benches in the open pit, allowing for more effective and less expensive diamond drilling.

The Company believes there is further potential to expand the Goldboro Deposit along strike, and at depth, and is planning a 50-line kilometre Induced Polarization geophysical survey over the area west of the Goldboro Deposit for approximately one kilometre up to the past producing Dolliver Mountain gold mine.

The Mineral Resource is based on validated results of 635 surface and underground drill holes, for a total of 113,132.9 metres of diamond drilling, including 45,408.7 metres conducted by Anaconda, that was completed between 1984 and the effective date of February 7, 2021.

Inferred Mineral Resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves.

The Goldboro PEA utilizes the Mineral Resource with an effective date of February 7, 2021, that is conceptually mineable with both open pit and underground mining methods.

Economic limits for the Open Pit were determined using Geovia’s Whittle™ 4.7 software that uses the Lerchs-Grossmann algorithm.

A 3D geological block model and other economic and operational variables were used as inputs into the LG program.

The envisioned selective mining excavator, at the onset of the analysis, would likely have a bucket width of ~ 2 m, the rock is planned to be mined on a 5 m operating bench height.

Mineral Resource material contained within the pit and above the cut-off grade is classified as potential mill feed , while resource material below the cut-off grade is classified as waste.

The Goldboro underground Mining Inventory was determined using Deswik’s Mineable Shape Optimizer based on the economic and geometric parameters as listed in Table 5 and Table 6.

Stope dimensions were designed on a 20 m level spacing and maximum 15 m length with an average mineralized width of 2.6 m.

The planned mining from underground consists of evaluated tonnes and grade within MSO shapes that met the minimum cut-off gold grade of 3.0 g/t gold, were outside of boundary constraints, and were assessed to be probable minable shapes.

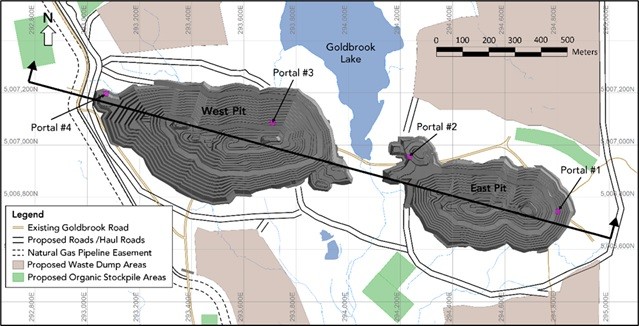

The PEA is based on a conventional truck-shovel open pit mining operation within two pits that transition to underground mining in year 6.

The dimensions of the West Pit are approximately 980 m long x 470 m wide x 240 m deep.

The PEA assumes contract mining will be used for the open pit mining activities.

Waste rock mined from the open pit is planned to be used for road and pad construction purposes and for the tailings facility embankment.

Underground production was scheduled based on approximately 1,500 tpd mill feed and 600 tpd waste, excavated using a fleet of 3.5 and 10 tonne load-haul-dump loaders, hauled with 30 tonne trucks using the ramps to portals entrances and rehandled using the surface fleet.

The process plant is expected to treat 1.46 Mt of potential mill feed per year at an average throughput rate of 4,000 tonnes per day with an expected availability of 92%.

Expected gold recovery has been calculated based on metallurgical test work completed on Goldboro open pit material in 2020, which was consistent with observations made from the metallurgical work performed on Goldboro underground material in 2018 and 2019.

The estimate of Initial Capital Costs is $286.3 million including working capital, indirect and contingency assumptions, as outlined in Table 8 below .

The sustaining capital, including rehabilitation and closure costs, fisheries and wetland compensation and the reversal of upfront working capital, is estimated at $329.9 million over the life of the mine.

At a US$1,550 per ounce of gold price and a US$:C$ exchange of 1:1.29, resulting in gold price of C$2,000, the Project generates an after-tax NPV 5% of $547 million, an after-tax IRR of 24.4% and an after-tax payback on initial capital of 3.2 years.

On a pre-tax basis, the Project generates NPV 5% of $805 million, and IRR of 29.0%, and payback of 2.9 years.

The main project infrastructure components include mine and process plant supporting infrastructure, site accommodation facilities, tailings management facility, external and internal access roads, power supply and distribution, freshwater supply and distribution, water treatment plant and construction/operations camp.

Further studies are required to determine the materials and method of construction that will be most cost-effective, efficient in construction, and appropriate to the local conditions.

With respect to site communications, cellular service is currently available at the site, as is Wi-Fi, but will need to be extended to the office and mill area.

A network of 13.8 kV overhead distribution lines would be installed at site to provide power sourced from the main substation for underground and surface infrastructure.

An external Polishing Pond constructed to the west of the TMF will be used to manage excess water from the TMF and will act as a settling basin and for clarification prior to treatment and discharge to the environment.

The EARD will be authored by Anaconda Mining and GHD and shall utilize extensive baseline data collected at the Project site by Anaconda and its consultants since 2017, when Anaconda acquired the Project.

Anaconda shall also apply for an Industrial Approval, planned for late 2022, and make applications for various permits associated with Mining and Crown Land access, mining, and milling permits, water use, wetland alteration, and sewage treatment to support authorization for the construction and operation of the Project.

Consultations have been ongoing with the Municipality of the District of Guysborough was established to foster environmental stewardship, and act as a conduit for transparent and ongoing communications between community, stakeholders, and Anaconda on all matters pertaining to potential development.

A Technical Report prepared in accordance with NI 43-101 for the Goldboro Gold Project PEA will be filed on SEDAR before August 9, 2021.

Mr. McNeill has verified the data disclosed in this news release, including sampling, analytical and test data underlying the information it contains.

Anaconda also operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~15,000 hectares of highly prospective mineral property, including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project.

The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company’s performance and ability to generate cash flow.

Operating Cash Costs per Ounce of Gold – Anaconda calculates operating cash costs per ounce by dividing operating expenses per the consolidated statement of operations, net of silver sales by-product revenue, by the gold ounces sold during the applicable period.

All-In Sustaining Costs per Ounce of Gold – Anaconda has adopted an all-in sustaining cost , sustaining exploration, and rehabilitation and reclamation costs.

Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including the risks outlined in this news release, risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Anaconda’s annual information form for the year ended December 31, 2020, available on www.sedar.com.