“At some point, a central bank will have Bitcoin on its balance sheet, that just will happen because central banks have gold on their balance sheet.

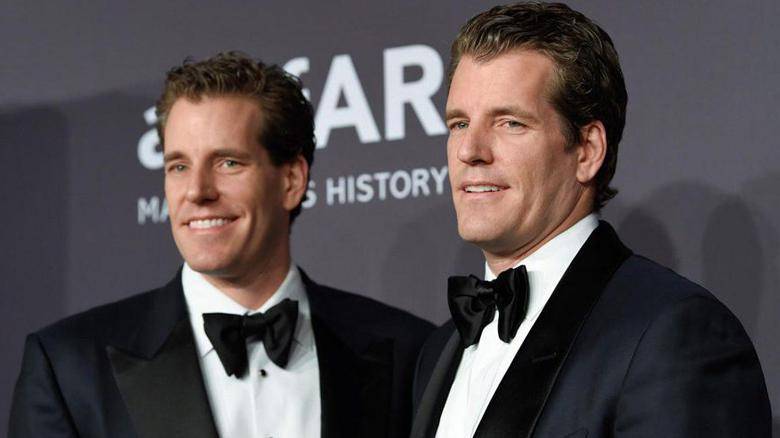

The famous Winklevoss twins — Cameron Winklevoss and Tyler Winklevoss — you may recall are known for their legal battle with Facebook, founder Mark Zuckerberg, but that is past.

“Our advice for Cryptocurrency investors in the Middle East would be start with a liquid and regulated investment that can be tracked in the context of a regular portfolio.

The shares are expected to start trading on Nasdaq Dubai in the second quarter.

Dalma Capital, a Dubai-based alternative investment firm, was 3iQ’s syndicate manager for the fund’s Middle East expansion.

in a lot of cases, if the banks found out they were sending money to cryptocurrency exchanges, they would actually close their accounts.

Seizing these exciting opportunities will require operational, legal and regulatory process upgrades as well as an alignment of accounting and internal control measures,” said the report.

Given the important role of commercial banks in money creation through the fractional reserve banking system, CBDCs will likely come with ‘forced intermediation’ – requiring CBDC holders to nominate an authorised member bank to ‘hold’ their CBDCs on their behalf and continuing to maintain exclusivity for commercial banks to hold deposits directly with the central bank, thus allowing commercial banks to continue to make fractional reserve deposits and lend excess cash.

Institutional involvement in CBDC continues to strengthen the ecosystem at large, with public stakeholders such as the Bank for International Settlements, the World Bank, the International Monetary Fund or the World Economic Forum, active on the topic.

More than 88 per cent of CBDC projects, at pilot or production phase, use blockchain as the underlying technology.