Whether or not that comes to pass, the selloff underscores a historic shift in the world’s second-largest credit market.

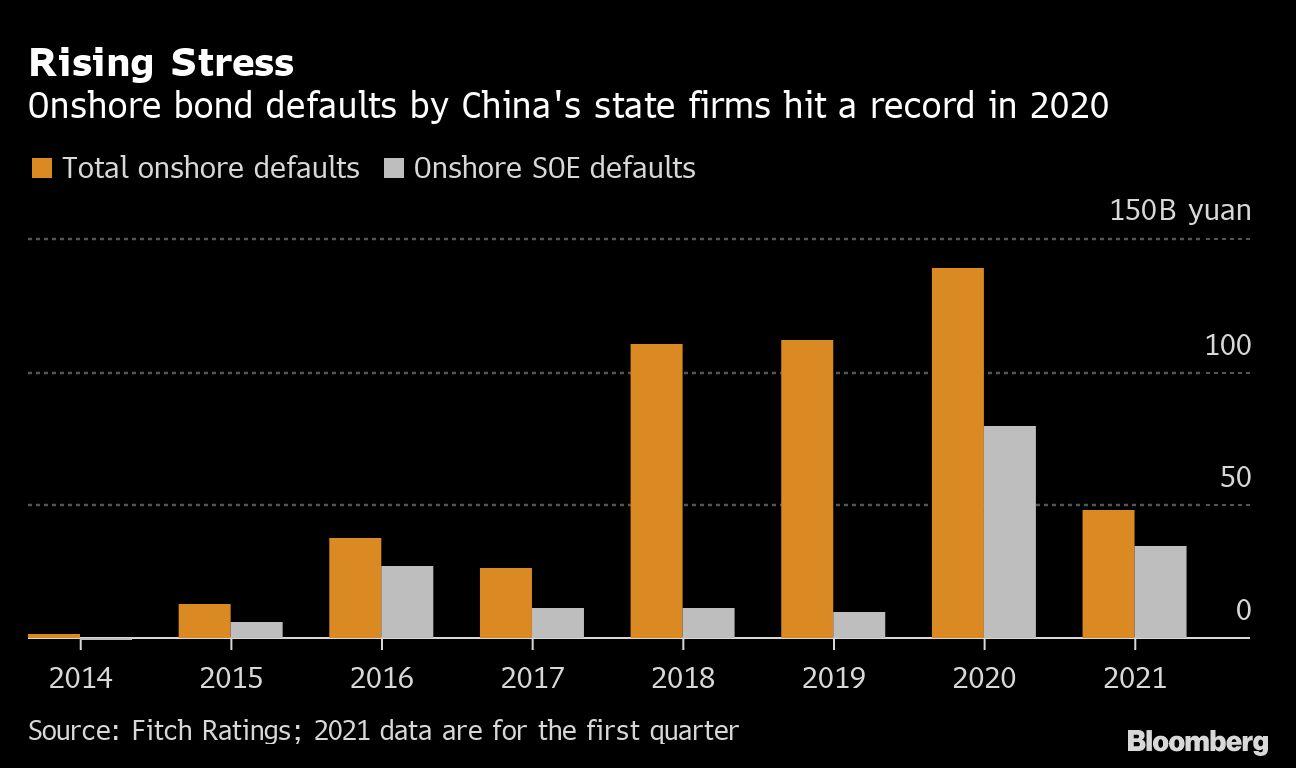

SOEs reneged on a record 79.5 billion yuan of local bonds in 2020, lifting their share of onshore payment failures to 57% from 8.5% a year earlier, according to Fitch Ratings.

The big question now confronting investors is how much pain China’s government is willing to tolerate as it tries to wean the bond market off implicit guarantees.

Chinese authorities have tried to strike a balance between instilling more market discipline and avoiding a sudden loss of confidence that might spiral into a crisis.

“China’s credit market is entering a new era as SOEs are emerging as the main source of stress,” said Shuncheng Zhang, an analyst at Fitch Ratings.

SOEs had the equivalent of $3 trillion in onshore bonds outstanding at the end of last year, or 91% of the total, data compiled by Fitch show.

Under his leadership, China Huarong expanded into areas including securities trading and trusts that were a significant departure from the company’s original mandate of helping banks dispose of bad debt.

Losses in the bonds accelerated on Tuesday — spreading to other Chinese issuers including property developers — as traders circulated a separate Caixin report discussing scenarios for China Huarong that included bankruptcy.

China Huarong bonds extended declines on Wednesday, with prices falling by as much as 5 cents on the dollar.

A surprise onshore default by a state-linked coal producer in November triggered a brief selloff as investors reassessed the creditworthiness of investment-grade Chinese debt.

Some level of contagion is actually healthy for China’s bond market as it shows investors are responding to changing levels of risk, according to Charles Chang, an analyst at S&P Global.

The finance ministry is considering transferring its controlling stake in China Huarong to a unit of the nation’s sovereign wealth fund that has more experience resolving debt risks, Bloomberg reported on Tuesday, citing a person familiar with the matter.

David Trainer, CEO of investment research firm New Constructs, said Coinbase has “little-to-no-chance of meeting the future profit expectations that are baked into its ridiculously high valuation.” Trainer last week put a valuation on Coinbase closer to $18.9 billion, arguing it will face more competition as the cryptocurrency market matures.

The photo-sharing site, which is owned by Facebook Inc, said this latest test came after seeing mixed responses to its experiments in which it removed likes, commonly used as a measure of popularity.

He said NOCSDC is waiting for the funding applications to be approved and that they’ve had engineers and architects in to look at the former school building which he said “is in very good shape” but still needs work.

A Maryland State Police trooper shot a 16-year-old boy dead after the teenager aimed what investigators later learned was a toy gun at the officer before pulling a knife on him, police said.

“It is a phenomenon that in recent days is becoming more serious than we might have thought,” Giovanni Pavesi told the regional health commission in Lombardy, which is centred on Italy’s financial capital Milan.

Annika Fagerlund har lång och bred erfarenhet av att leda affärsverksamhet och IT funktioner inom bank och finans i Sverige och internationellt.

New York timeThe NASDAQ Composite Index was little changedThe Dow Jones Industrial Average rose 0.7% to a record highThe Stoxx Europe 600 Index rose 0.2%The MSCI World Index rose 0.3% to a record highCurrenciesThe Bloomberg Dollar Spot Index was little changedThe euro was little changedThe British pound climbed 0.3%, more than any closing gain since April 5The Japanese yen was unchanged at 109 yen per dollarBondsThe yield on 10-year Treasuries advanced 2.7 basis points to 1.641%Germany’s 10-year yield advanced 2.9 basis points, climbing for the fourth straight day, the longest winning streak since Feb.

Now Facebook says it’s going to test out — again — an option for users to hide those “like” counts to see if it can reduce the pressure of being on social media.