There are times when equities and bonds correlate, resulting in negative returns for 60/40 portfolios.

Persistently high inflation, war in Ukraine, and a hawkish Fed have so far proven to be an acid cocktail for 60/40 portfolios.

Rising commodity prices come at a time when inflation is already high, putting more pressure on the Fed to hike, while uncertainty remains high.

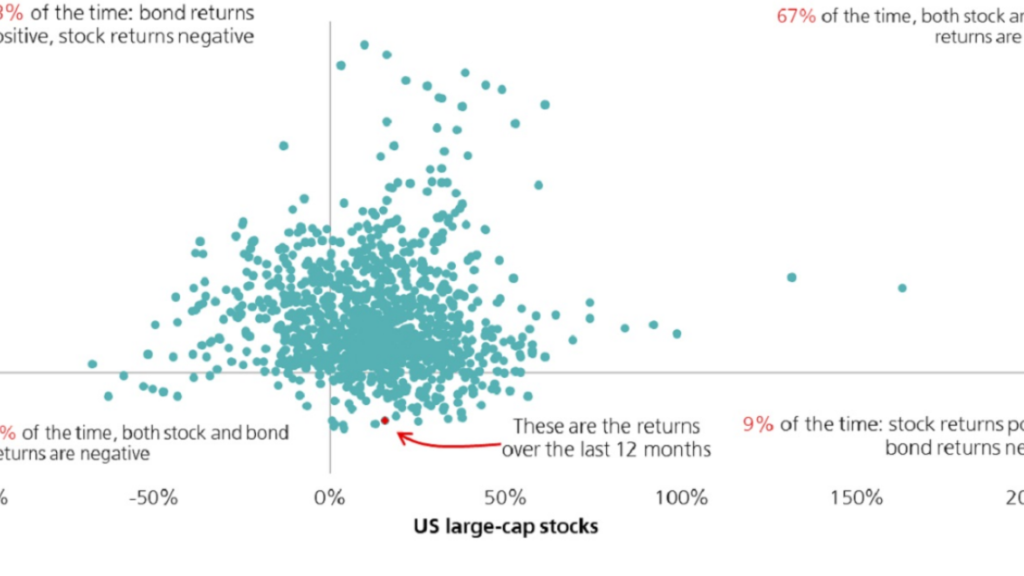

Based on 12-month rolling total returns , stocks and bonds have simultaneously recorded negative returns only 1% of the time, and when they did, on a rolling basis, bonds’ 12-month declines have been limited to single digits.

There have been episodes when equities and bonds have started correlating, as we have observed this year.

In the current environment of elevated inflation, with commodity prices rising to new record highs, we advise gaining exposure to commodities.

It is important that you understand the ways in which we conduct business, and that you carefully read the agreements and disclosures that we provide to you about the products or services we offer.

Wealth management services in the United States are provided by UBS Financial Services Inc., a registered investment advisor and broker-dealer offering securities, trading, brokerage and related products and services.