With equity markets likely to remain volatile, we suggest positioning toward areas of the market that can perform well in an environment of high inflation, rising rates, and elevated volatility.

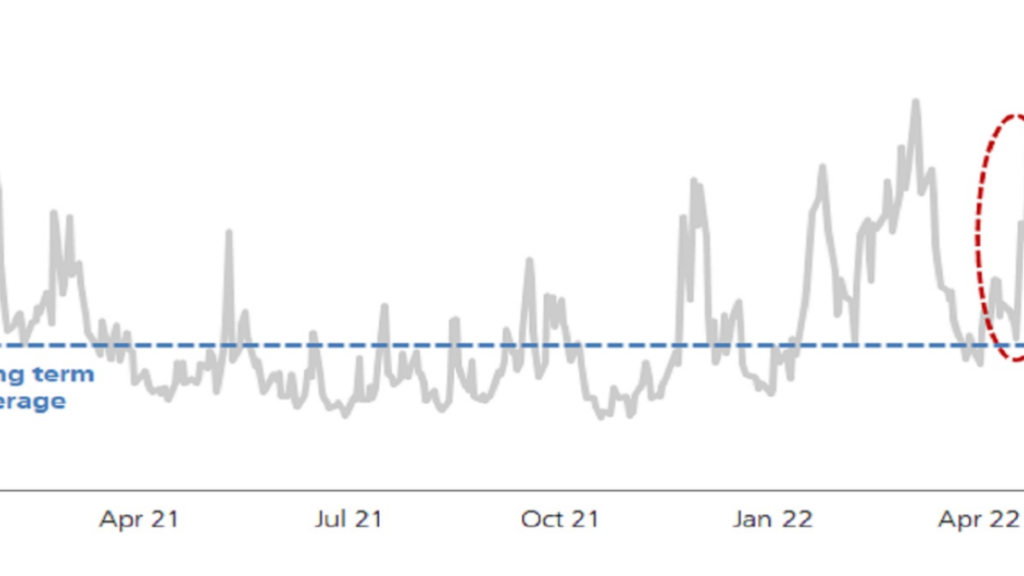

The VIX index of implied US stock option volatility is trading above 30 again.

Recent commentary from Fed officials has been increasingly hawkish, and the futures market is pricing a fed funds rate of around 2.7% at the end of 2022.

The Russian gas export developments out of Europe are a reminder that the potential of the war in Ukraine to escalate and drive energy prices higher looms over the market in the near term.

However, with current valuations pricing in many of the negatives and Beijing expected to step up fiscal and monetary support, we forecast MSCI China to end the year higher and recommend adding positions in cyclical and value sectors, as well as in those that have embarked on share buyback programs or plan to do so soon.

In this environment of increased geopolitical risks, threats to growth from China’s lockdowns, and uncertainty over the prospect of overtightening by the Fed, we think equity markets are likely to remain volatile.

Year-to-date the Broad Bloomberg Commodity index is up around 30% compared with a roughly 13% loss for the MSCI All Country World index, and the 52-week correlation between the two indexes has dropped to zero.

Value sectors like energy suffer less of a drag in a rising rate and higher inflation environment than growth sectors, such as technology, where valuations tend to be more reliant on future profits.

We have become more balanced between cyclicals and defensives in our equity positioning, with energy and healthcare our most preferred sectors.

For investors willing and able to lock up capital and accept the additional risk this entails, direct lending can provide enhanced income opportunities in excess of public market returns.

Building up a Liquidity strategy can help reduce the risk of “forced selling,” while structured investments or dynamic asset allocation strategies can also help investors manage drawdown risks while staying invested.

This approach is not a promise or guarantee that wealth, or any financial results, can or will be achieved.

It is important that you understand the ways in which we conduct business, and that you carefully read the agreements and disclosures that we provide to you about the products or services we offer.

Wealth management services in the United States are provided by UBS Financial Services Inc., a registered investment advisor and broker-dealer offering securities, trading, brokerage and related products and services.