Are you interested in virtual currency, now trading at half the price it had last fall? Shop around.

There are pros and cons to every means of getting cryptocurrency exposure, including the little outfit in Fairfield.

This quasi-fund , created a little over a year ago, is a knock-off of the much better-known Grayscale Bitcoin Trust.

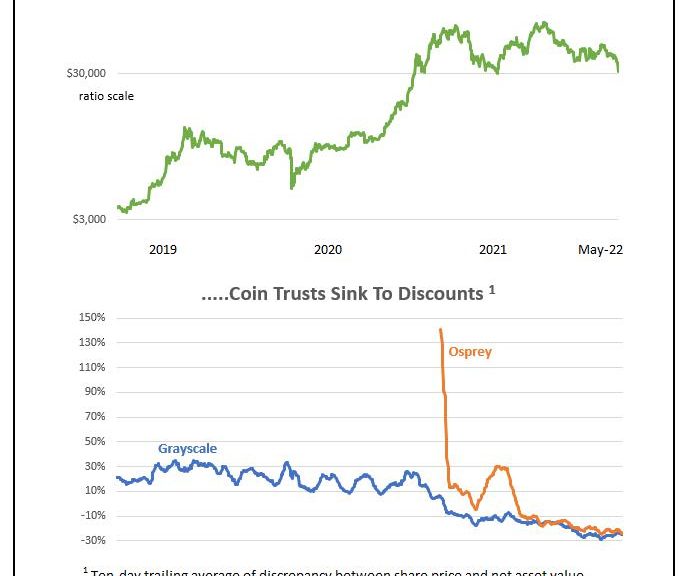

The trusts trade at discounts to the value of the bitcoins they hold: recently 26% at Osprey, 28% at Grayscale.

Bear markets have a way of doing double damage to closed-ends, depressing their share prices even faster than prices decline on the assets they hold.

So far the agency has rejected every application for a coin ETF, although last year it did greenlight an ETF that holds bitcoin futures contracts.

A bearish view of coin trusts comes from Tyler Odean, publisher of Something Interesting, an insightful Substack newsletter on crypto.

It’s far more likely that bitcoin will crash another 50% than that the discount will make a comparable move from 26% to 63% .

Osprey has but $100 million of coins in its vault, and its average daily share volume over the past year would be worth $400,000 at today’s share price.

The computer you use to generate the private and public keys for your coin repository has to be permanently isolated from the internet.

You could leave your coins for safekeeping at a coin exchange.

At Coinbase Global, where the minimum account size for this service is $500,000, the fee is 0.5% a year.

But, unlike stocks at a brokerage firm, coins left with an exchange have no Securities Investor Protection Corporation to back them if the middleman gets into financial trouble.

While our SEC bides its time, the Canadian regulator has authorized exchange-traded funds that hold cryptocurrency.

It’s not easy to get your hands on these shares in the U.S., as most brokers will refuse the buy order.

Trading volume, almost all of it in the nearest month, typically runs to $1 billion a day.

It means that the futures price at which you’re buying is at a premium to the spot price.

The ProShares Bitcoin Strategy ETF holds long positions in bitcoin futures.