Before the ball was struck, Mr Ramsdale was on his toes, his weight distributed evenly, ready to jump in either direction.

A market in which bets are slanted in one direction is vulnerable to a big swing in prices the opposite way.

You conclude that the Federal Reserve will have to raise interest rates sooner than people expect and a lot sooner than the European Central Bank.

In the event of unexpected news that is positive for the euro, the speculators who are short the currency would be nursing losses.

Perhaps this is why a lot of the recent discussion of volatility has been focused on liquidity—how easy it is to get in or out of a position quickly.

In the halcyon days before the financial crisis, there were marketmakers who were willing and able to lean against momentum, to take a view based on fundamentals, and to hold bonds for more than a day .

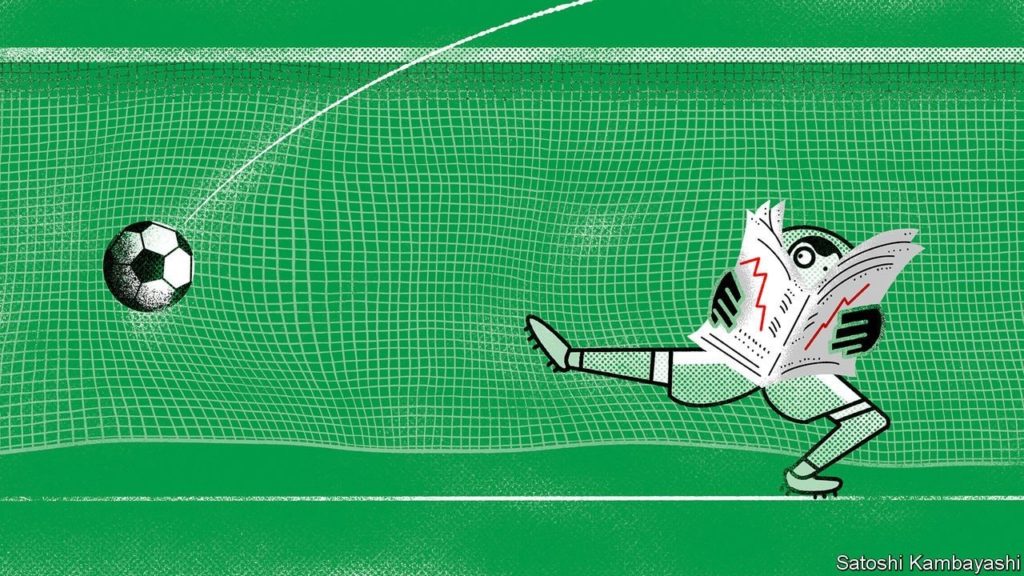

In this regard, the bond market is like a goalkeeper who gambles on where a free kick is going.